HPL Electric & Power Ltd : The age of smart meters.

Nothing shared in this report is a buy or sell recommendation. Please do your own due diligence before buying or selling.

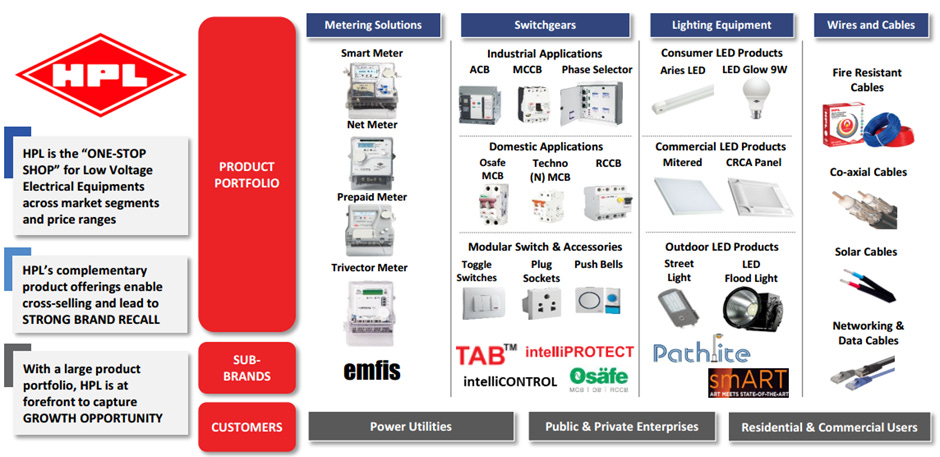

HPL Electric & Power Limited is an electrical equipment manufacturer in India operating for the past 40 years. It has two new segments: metering and systems and consumer and industrial. The metering and systems segment now includes the company's metering systems and project businesses under one head. In contrast, our consumer and industrial segment comprises the wire end cables, lighting, luminals and switch gear business. The former is more institutional and B2B centric, while the latter is more consumer and B2C-centric.

It caters to a wide spectrum of customer segments, such as power utilities, government agencies, and retail and institutional customers, with a strong brand recall as a trusted electrical brand.

It exports its finest engineering goods to more than 42 countries in regions of Asia, Africa, Europe, UK and Indian Sub-continent through the overseas logistic partners

Segmental Revenues:

It can be seen that the Metering & System segment is growing fast. This is where our interest is. Presently the conventional meters are replaced by smart meters. So there is a value migration from old to new smart meters. This is a major tailwind for the company. Let’s see how this can be a game changer.

HPL is approved as a bidder through tender participation for the appointment of Advanced Metering Infrastructure Service Provider-AMISP [It’s basically a middleman type of company acting betweent smart meter supplier like HPL and the customer DISCOMS (DISCOM means Power Distribution Company of the state, responsible for distribution of Electrical power in the region and associated activities.)] for Smart Prepaid Metering in India on a DBFOOT (Design, Build, Finance, Operate and Transfer) basis under the Revamped Distribution Sector Reform Scheme(RDSS).

HPL is one of the few participants to receive the Empanelment Certificate after being subjected to vigorous testing carried out at the Central Power Research Institute (CPRI) laboratory. This Certificate enables the company to participate in the massive opportunity to take a slice of the 25 crore smart-meter market. It takes time to receive this certificate. Only 7-8 players have this and the mgmt. considers only 3-4 players as serious competitio

So how this recent development does is a game changer? Enquiry base for Metering tenders is now amounting to ~ ₹ 10,000 cr+ have been floated or are expected to be floated in the near term. Before receiving the certificate this Enquiry base used to be 1500 cr+. So basically now the size of opportunity has grown by multifold.In the latest concall mgmt told they are expecting large orders in coming quarters.

The commentary: “The opportunities are pretty large. The smart meter is seeing some kind of change. The whole metering industry is seeing a change, which probably has not been seen in the last maybe 20, 25 years. The industry size is set to grow. The sheer quantum of business that is ready to flow out is very enormous.”

Overall order book of ₹ 834 crores ensures revenue visibility for the short and medium term. Meter & systems contribute 60% and the consumer and industrial segment contributes 40% of the current order book.

The current orders which have been coming out from the utilities directly, in that the executions are typically around nine months, like one month to two months of waiting, like getting preparation done and then executing in about five months to six months. For new orders through the AMISPs (a middle man company acting between govt DISCOMS and suppliers like HPL) , there is the period of implementation, the values will go up, but the period of implementation maybe 18 months, it could be even two years.

The current meter order book has more than 50% Smart Meters and it is expected that the share of Smart Meters to rise even further. Smart meters attract higher realizations, thereby resulting to increase revenue and enhanced profitability.

There is no capex required for catering to the new orders all the capex is already in place. The facility for making ordinary meters and smart meters are interchangeable.

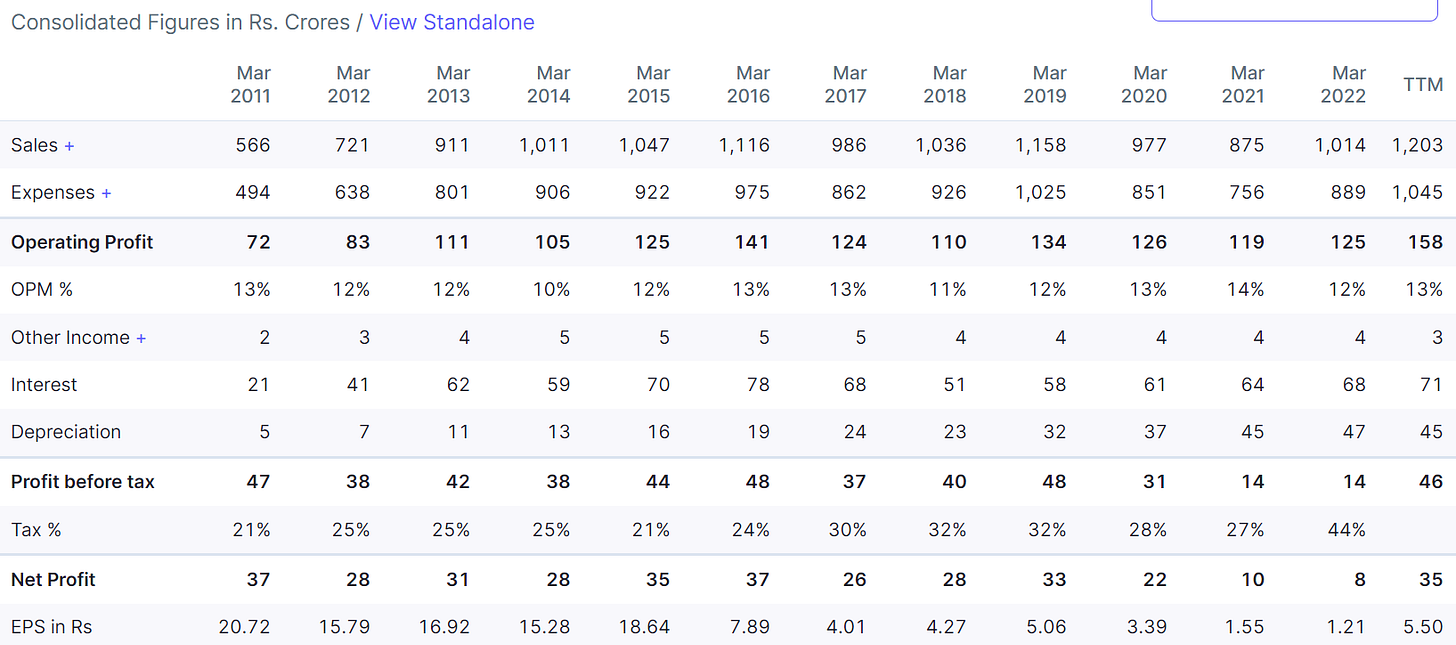

The co has low ROE. But the mgmt. expects it to go up once the smart meters are in the middle of their implementation; might see an upward correction on the margin. So once better capacity utilization happens and more volume comes ROE should improve.

Mgmt expects to reach 2000 cr revenue within 2-3 years. Mgmt is conservative while giving any kind of guidance. In Q1FY23 concall they told about 1200 cr revenue in FY23 which is 20% growth over FY22. Already 600 cr done in H1FY23.

Valuation: HPL seems to be undervalued given the tailwinds it has. Due to lack of growth and general correction in small caps it corrected a lot. Now that growth is happening it can rerate further.

Also, the company is having highest ever profit but price is still 32% below all-time high

Antithesis

High Working Capital Days. The metering segment has 180 days receivable days and the consumer electric segment has lower debtor days. The mgmt. believes the bigger orders which are yet to be won will be through a big man company acting as a middleman between HPL and the DISCOMS to whom HPL directly supplies now. So it will result in better debtor days which will reduce requirement of WC loans thus reduction in WC days. But the reverse argument is the middle man company will deal with the govt owned DISCOMS which will cause high debtor days so the middleman company can simply pass that on resulting in no improvement in the debtor days of HPL thus no improvement in WC days.

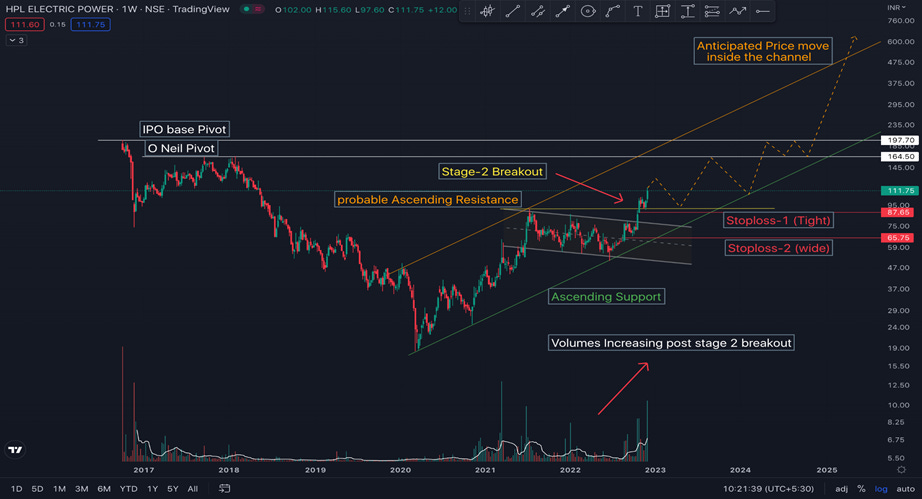

Technicals:

The price is still inside the IPO base which looks like a Rounding Bottom base.

The Right side of which is under construction.

It has come out of a Stage-1 consolidation base and entered Stage-2 with volumes confirming.

Price now might look to move in the Ascending channel (marked Support and Resistance)

The O’ Neil base pivots and the IPO base pivots (ATH price) might act as minor resistance.

If taken an entry, there are 2 Stop Loss areas that make sense:

Below 87 tight

Below 65 loose

The Bullish view will fail or halt if price breaks down below the Ascending Support (green line)

Quarterly Updates:

Q1FY23

1. 20% revenue growth guidance for FY23.

2. How is the demand trajectory for smart meters going forward? Can we expect a rise in order or tenders being floated by the government or DISCOM? What is the expected size of the tenders: Yes, if you see the smart meter that it has an upside, and if you see, even just a week, 10 days back, in fact, on 30th of July, the Prime Minister has launched the RDSS scheme, the Revamped Distribution Sector Scheme, and that again entails a massive demand for smart meters. So now, overall, if you see there is a lot of activity by the government is focusing on the smart meters, the demand side will be huge. So, of course, we are well aware of it, and a lot of actions have been taken in the last two years to bring about a complete readiness and preparedness for us to exploit that. The orders have started flowing, our all-current date orders are over INR 200 Crore only on the smart meters.

So the industry is changing although there are a lot of orders currently even of the regular conventional meters coming in but smart meter tenders are at a pretty high point today. Right now, as you are aware, REC is conducting the empanelment of the AMISPs of all the system integrators. Once that process is done, the tender flow will be much, much higher, so already at an Enquiry stage, I would say a lot of tenders are coming out and they are under discussion. But if you look at the live tenders, which are there right now in the market, which are probably out or what we have participated in, that would be somewhere around INR 1500 Crore to INR 2000 crore, but the share Enquiry basis is getting to be very large and very big. Yes. So probably in the second half of this year, we should see a lot of tenders getting finalized. Of course, if there are smart meters along with the infrastructure and the complete system, then the execution would probably happen in the next three to four years, and that's how it is. But yes, we would see a significant influx of tenders coming in and a lot of orders getting finalized in the near term.

Q2FY23

1. Sharp improvement in the working capital cycle, as the cycle improved by 33 days.

2. Both our Metering and Systems and our Consumer and Industrial segments delivered a strong performance in the current quarter. The growth prospects of the Metering and Systems seem very bright in the coming years and look to be promising for this business segment. The entire Metering business is evolving, and we expect to see a substantial upside in the segment in the foreseeable future.

3. The Company is approved as a bidder through tender participation for the appointment of Advanced Metering Infrastructure (AMI) Service Provider for Smart Prepaid Metering in India on a DBFOOT (Design, Build, Finance, Operate and Transfer) basis under the Revamped Distribution Sector Reform Scheme(RDSS). HPL is one of the few participants to receive the Empanelment Certificate after being subjected to vigorous testing carried out at the Central Power Research Institute (CPRI) laboratory. This Certificate enables the company to participate in the massive opportunity to take a slice of the 25 crore smart-meter market.

4. We have recently received an Empanelment Certificate, can you please share how many tenders we have received post getting the Empanelment Certificate?:

· The government is going about the smart metering under their DBFOOT policy and also the metering which happens under the RDSS scheme, which is a Revamped Distribution Sector Scheme. Under that, the Empanelment is a must for anybody taking on system integration. So as a company, we are one of the few companies that have got Empanelment through the process, and as a AMISP, where we are capable of executing the projects of the smart meters. So now this is a process that is still going on. I think there are about 20 to 25 companies that are already approved as the AMISPs, and these are fairly big and very large companies that have come into this field.

· Now coming to your question. Although the process is still going on for certain few companies getting the Empanelment, the tenders have already started. So the current Enquiry bank under this new scheme is also fairly large. But overall if you see, the meter Enquiry banks are well over INR 10,000 crores and I repeat, it's over INR 10,000 crores.

· So for the first time, we are seeing the overall Enquiry base really increase and some orders, I think, have already started coming in. We have received a few smaller orders, But for the larger orders, because they would involve much bigger planning, more evaluations would be fairly more elaborate, that may be from the next quarter or the first quarter in the next year- that is the time when we find or we should see a maximum number of orders getting finalized. But every week, practically, we can say that new tenders are coming out.

· The good thing is that the government came out with something which is equivalent to the standard bidding model, like the standard bidding document. I think that was given out earlier. There were a lot of public discussions and all the stakeholders involved were well consulted and discussed. So the guidelines which have come out in the DBFOOT are practically being followed by different states.

· So what we are likely to see is a big rush of inquiries, which has already started. Since they are all following the standard bidding documents and the guidelines by the government, they would be fairly consistent. So for us to have our strategy in place for quoting or even in terms of the pricing or the cost involved and the interest cost, whatever, that becomes pretty much standardized and I think out of our experience- people will learn from that.

· So the process has started. Certain orders have coming. But I think the next quarter and the quarter after that are definitely going to see very, very large orders getting finalized. We will be having a dual advantage of being an approved Empaneled AMISP, plus being a very large supplier of smart meters, we definitely have two big opportunities within the smart meter segment.

· The opportunities are pretty large. The smart meter is seeing some kind of change. The whole metering industry is seeing a change, which probably has not been seen in the last maybe 20, 25 years. The industry size is set to grow. The sheer quantum of business that is ready to flow out is very enormous.

5. As a company, if you look at the next three years, five years, even longer than that, definitely, we see very, very good growth coming in and improvement in our market share for sure, and also an improvement on the margins. That is where we see the company move forward.

6. Capex: If you see all the opportunities that I just talked about, most of our capex is already in place. However, there is some maintenance capex, which normally happens more because of the tools and dyes that the company which is more wherever they get worn out based on use. So I think the maintenance capex of about INR 30 crores odd what happens, that would continue. But overall, in terms of all the opportunities and the various business segments that we have, we still have a good capacity, which we need to increase. And in fact, the capacity utilization in the last two quarters, especially on the meters have gone up. But still, we have a large capacity to fill up and we are definitely poised to take advantage the market is currently offering us. So no major capex right now, yes.

7. WC Days: So overall, as a company, both these segments have different approaches to the management of the working capital. But overall, we have been able to bring it down this time right from inventory and the overall working capital. So we have got it down in the first 6 months. And hopefully, we do see growth in our revenues in the second half of the year as well and the target is, obviously, very clear to again bring down the net working capital and the inventory days further by the time we reach March 2023 year.

8. WC Days: Yes, you're right. If you look at the major opportunity, like if you look at the opportunities of the AMISPs, who are going to be the system integrators and who are going to do the state-wise implementation, so order values, of course, are going to be very high, ranging from INR 500 crores to even going up to INR 2,000 crores, INR 3,000 crores, even higher than that. So the orders are going to be much larger. But all these AMISPs will need one or two and I think the government has mandated at least a minimum two smart meter manufacturers to give them. So definitely, the bigger opportunity for us is going to be the supplies of the smart meters, that is where we will be focusing. In fact, with the utilities, when traditionally they have been buying, the debtor days are typically around five months or six months.

But I think under the new scenario, we will see that to improve, because, right now, between us and the utility, there is going to be a private AMISP, who will be typically a very large private company and with good financials and others. So maybe there is a very strong possibility that on the supply side in this type of opportunity, we may see a drastic improvement in the working capital cycle, especially with the debtors coming in a fixed number of days under Bank LC.

So let's see how things are unfolding. But my personal take would be that the working capital will improve in this scenario once this happens, yes. On the other side, we have already the consumer business, which is really going to be there. I think if these two combine, definitely maybe in one to two years once the smart meters are unfolding in a bigger way. We might see a good drastic correction in the working capital cycle of the company.

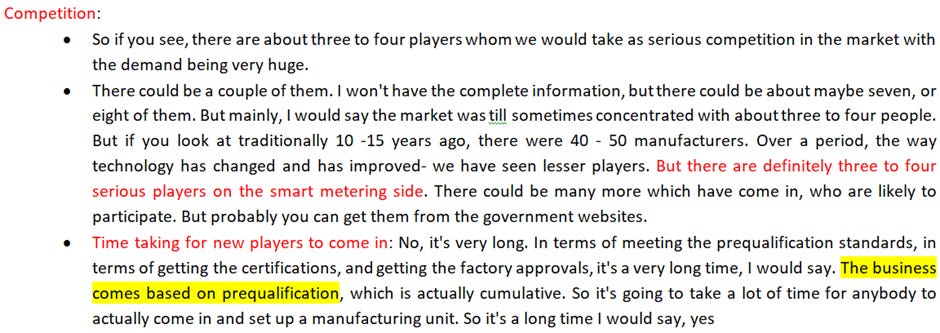

9. Competition:

· So if you see, there are about three to four players whom we would take as serious competition in the market with the demand being very huge.

· There could be a couple of them. I won't have the complete information, but there could be about maybe seven, or eight of them. But mainly, I would say the market was till sometimes concentrated with about three to four people. But if you look at traditionally 10 -15 years ago, there were 40 - 50 manufacturers. Over a period, the way technology has changed and has improved- we have seen lesser players. But there are definitely three to four serious players on the smart metering side. There could be many more which have come in, who are likely to participate. But probably you can get them from the government websites.

· Time taking for new players to come in: No, it's very long. In terms of meeting the prequalification standards, in terms of getting the certifications, and getting the factory approvals, it's a very long time, I would say. The business comes based on prequalification, which is actually cumulative. So it's going to take a lot of time for anybody to actually come in and set up a manufacturing unit. So it's a long time I would say, yes

10. So as we go forward, in the traditional meters, in the electronic meters, we have been enjoying a 22% market share across many years. I think going forward, in this, definitely, we hope to have a much larger share, maybe at least a 25% market share in the smart meter segment that would come by.

11. As I said earlier, the opportunities will come in two ways. One -- the main part will always be that HPL Electric being a big supplier to all the AMISPs. That's where the major part of the growth is going to come from. The other being taking up projects under AMISPs. But that would happen very selectively if ever, that would happen. But majorly, as HPL Electric, we are focused on our core competence of smart meters and the demands have already started coming in and that's how we would see the near-term growth, yes.

12. Smart meters debtor days: 5-6 months.

13. Capacity for manufacturing traditional and smart meters are interchangeable.

14. The per unit cost of smart meter with the entire infrastructure is much, much higher than a traditional meter. So the same amount of sales, actually, a lesser volume needs to be done of smart meters. But the value adds are very high per meter.

15. Can ROE Reaching double digit?: Look, I will not be able to give you a specific time schedule on that or something. But if you see all the steps that the company is doing, we do see the growth coming in. We do see certain margin improvement. In fact, once the smart meters are in the middle of their implementation, we may see an upward correction on the margin, especially on the smart meters. The EBIT margin is set to go up. In terms of the balance sheet, where our teams have already very conscious and specifically working on improving our working capital cycle or other ratios. So I think as we see this better capacity utilization coming in and the volumes to kick in, definitely, I think we would be able to see a better return on equity. But right now, to give a specific time, I think we have a slightly longer way to go on that. But definitely, the direction I would say is right. We are moving in that direction. But no specific schedule I could give you on that.

16. Orderbook and execution time:

· Our order book is, I think it's about INR 830 crores plus. And out of that, about INR 504 crores, I think, are meters right now.

· If you see the current orders which have been coming out from the utilities directly, in that the executions are typically around nine months, like one month to two months of waiting, like getting preparation done and then executing in about five months to six months. For new orders, what we will see through the AMISPs, there is the period of implementation, the values will go up, but the period of implementation maybe 18 months, it could be even two years.

2000 cr revenue within 4-5 years?: I think that would happen well before that for the INR 2,000 crores, yes. I think there I could give guidance on, just rough guidance from my side. But that can happen much before that also. Maybe in the next two years to three years, we hope that can happen, but what I was talking about is that sometimes there could bea much more substantial increase because of the volume of orders which are coming in, for that, that will require much deeper planning the way, because that is the business would get positively changed based on the enormous demand coming in, yes. But otherwise, the way we are seeing the growth in the next three years, I think that should ideally happen, yes